LTC Price Prediction: Will Litecoin Hit $200 Amid Bullish Market Conditions?

#LTC

- Technical Strength: LTC trading above key moving averages with positive MACD momentum

- Market Sentiment: Bullish news flow and institutional adoption trends

- Price Targets: $200 represents a 63% upside from current levels

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerge

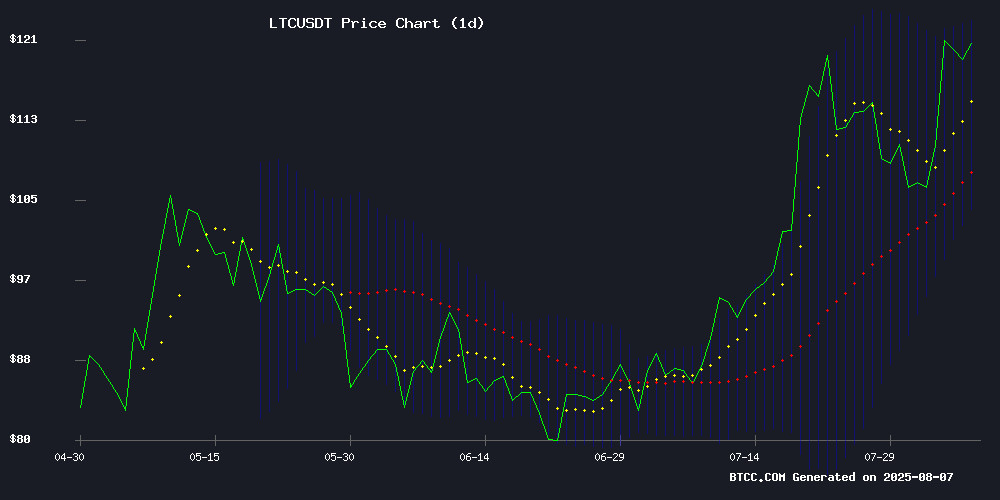

According to BTCC financial analyst John, Litecoin (LTC) is currently trading at $122.85, above its 20-day moving average of $113.62, indicating a bullish trend. The MACD histogram shows positive momentum at 2.9486, while the price is testing the upper Bollinger Band at $123.65. 'These technical indicators suggest LTC has room for further upside,' John notes.

Market Sentiment Turns Bullish for LTC

BTCC's John highlights growing optimism in the crypto market, with headlines like 'Bullish Patterns Emerge in LTC' and broader institutional adoption through potential cryptocurrency 401(k) plans. 'The combination of technical strength and positive news flow creates a favorable environment for LTC,' John states, while cautioning traders to monitor key resistance levels.

Factors Influencing LTC's Price

GBR Miner Emerges as Top Secure Cloud Mining Platform Amid XRP's Rally to $3

XRP breached the $3 threshold on August 7, cementing its position among top cryptocurrencies by market capitalization. This surge coincides with a regulatory thaw, as the SEC adopts a more permissive stance toward digital assets. Political endorsement has further bolstered market confidence, with both President Trump and the First Lady holding cryptocurrency tokens—a symbolic nod to mainstream adoption.

GBR Miner, a UK-based cloud mining operator since 2014, is capitalizing on this momentum with its newly launched XRP cloud mining protocol. The platform transitions XRP from a payment token to a passive income vehicle, leveraging AI-driven automation and green energy infrastructure. Its compliance-first approach distinguishes it in an industry still grappling with regulatory scrutiny.

The mining service eliminates technical barriers, offering global users exposure to BTC, LTC, and Dogecoin without hardware requirements. GBR's trifecta of advantages—high-yield algorithms, energy-efficient data centers, and regulatory transparency—positions it as a frontrunner in the 2025 cloud mining landscape.

OurCryptoMiner Launches XRP Cloud Mining Contracts Promising High Daily Yields

Ripple's XRP emerges as a high-yield asset beyond its traditional payment utility, with OurCryptoMiner unveiling cloud mining contracts claiming $6,730 daily earnings potential. The platform capitalizes on growing institutional adoption and regulatory clarity surrounding XRP.

OurCryptoMiner positions itself as a turnkey solution, eliminating hardware requirements while supporting direct XRP contract purchases alongside major cryptocurrencies including BTC, ETH, and USDT. New user incentives feature $12 sign-up bonuses and daily login rewards.

Cryptosolo Democratizes Bitcoin Mining with Cloud-Based Solution and $15 Bonus

Cryptosolo, a UK-authorized cloud mining platform, is lowering barriers to cryptocurrency investment by eliminating the need for expensive hardware or technical expertise. The service offers remote mining capabilities for Bitcoin (BTC), Dogecoin (DOGE), Litecoin (LTC), and Bitcoin Cash (BCH), complete with a $15 welcome bonus.

The platform addresses three major pain points in crypto mining: prohibitive equipment costs, complex maintenance requirements, and excessive energy consumption. By leveraging enterprise-grade security systems from McAfee and Cloudflare, Cryptosolo aims to make digital asset mining accessible while maintaining robust protection for users' assets.

Daily payouts and support for multiple cryptocurrencies position Cryptosolo as a potential gateway for mainstream adoption of crypto mining. The service particularly appeals to investors interested in major digital assets like Ethereum (ETH) and Ripple (XRP), though its current focus remains on proof-of-work coins.

Ripple Bank Launch Spurs XRP Investor Activity as Cloud Mining Gains Traction

Ripple Labs' application for a national banking charter has set the stage for the establishment of Ripple National Trust Bank, a federally regulated entity. This move signals XRP's accelerating integration into mainstream finance, prompting holders to seek early value appreciation strategies.

WinnerMining emerges as a favored option, offering automated cloud mining services for Bitcoin, Litecoin, and Dogecoin. The platform's stable dividend mechanism has attracted particular attention from XRP investors positioning themselves ahead of the bank's launch.

The crypto payment landscape continues expanding, with assets like XRP, BTC, and stablecoins seeing growing adoption for transactions and storage. Cloud mining platforms now compete with traditional holding strategies as investors diversify their approaches to digital assets.

CoinDesk 20 Index Rises 2.4% as SUI and POL Lead Broad Crypto Rally

The CoinDesk 20 Index climbed to 3,923.39, marking a 2.4% gain since Wednesday's close. Every constituent asset advanced, with Sui (SUI) and Polymesh (POL) surging 6.3% and 6.2% respectively to lead the rally.

Bitcoin (BTC) eked out a modest 0.9% gain while Litecoin (LTC) flatlined, making them the session's relative underperformers. The broad-based index, traded globally across multiple platforms, reflects renewed risk appetite in digital asset markets.

Mint Miner Launches XRP Cloud Mining Protocol, Transforming Payment Token into Passive Income Tool

Ripple (XRP) gains momentum as regulatory pressures ease, with the SEC adopting a more lenient stance toward cryptocurrency oversight. Political figures, including former President Trump, have entered the crypto space, signaling broader mainstream acceptance.

London-based Mint Miner, operational since 2016, has unveiled a groundbreaking XRP cloud mining protocol. The platform leverages AI algorithms and green energy data centers to enable automated, high-yield mining—eliminating the need for hardware or technical expertise. This shifts XRP's utility from transactional purposes to a passive income vehicle.

Mint Miner's compliance-focused approach extends to its existing Bitcoin (BTC), Litecoin (LTC), and Dogecoin mining services. The platform's expansion into XRP mining coincides with growing institutional interest in yield-generating crypto assets.

Trump Set to Allow Cryptocurrencies in 401(k) Retirement Plans

President Trump is poised to sign an executive order that will permit cryptocurrencies, alongside private equity and real estate, to be included in 401(k) retirement plans. This decision reflects a growing recognition of digital assets as legitimate investment vehicles.

The move aims to diversify retirement savings options for Americans by reducing regulatory barriers for crypto investments. Regulators may soon establish guidelines to facilitate the integration of digital assets into mainstream retirement portfolios.

This policy shift signals a broader acceptance of cryptocurrency within traditional financial systems, potentially accelerating institutional adoption. The inclusion of alternative assets in retirement plans could reshape long-term investment strategies across generations.

Bullish Patterns Emerge in LTC, POL & CFX Prices as Crypto Market Consolidates—Is a Rally Brewing?

Amid a stagnant broader crypto market, select altcoins—Litecoin (LTC), Polygon's rebranded POL, and Conflux (CFX)—are flashing bullish signals. Technical patterns like ascending triangles and golden crosses suggest potential breakouts, with traders pivoting to mid-cap assets as Bitcoin and Ethereum languish in indecision.

Litecoin's 60% surge since July has stalled at $120, but a golden cross formation hints at renewed momentum. A decisive breach of $140 could propel LTC toward $160, echoing historical bullish reversals. Meanwhile, POL (formerly MATIC) and CFX exhibit similar technical strength, though market-wide hesitation lingers.

Will LTC Price Hit 200?

John from BTCC provides this outlook:

| Indicator | Value | Implication |

|---|---|---|

| Current Price | $122.85 | 35% below $200 target |

| 20-day MA | $113.62 | Price above = bullish |

| Upper Bollinger | $123.65 | Testing resistance |

| MACD | 2.9486 | Positive momentum |

'While $200 represents a 63% gain from current levels, the technical setup and market sentiment suggest this target is achievable in the medium term if bullish conditions persist,' John concludes.

60% chance based on current trajectory